Support the Development

The Silver Valuation Index platform is free, open-source intelligence. If these tools help you, consider supporting the build.

SilverValuationIndex.com

GLOBAL EARLY WARNING SYSTEM

Active Intelligence Nodes

-

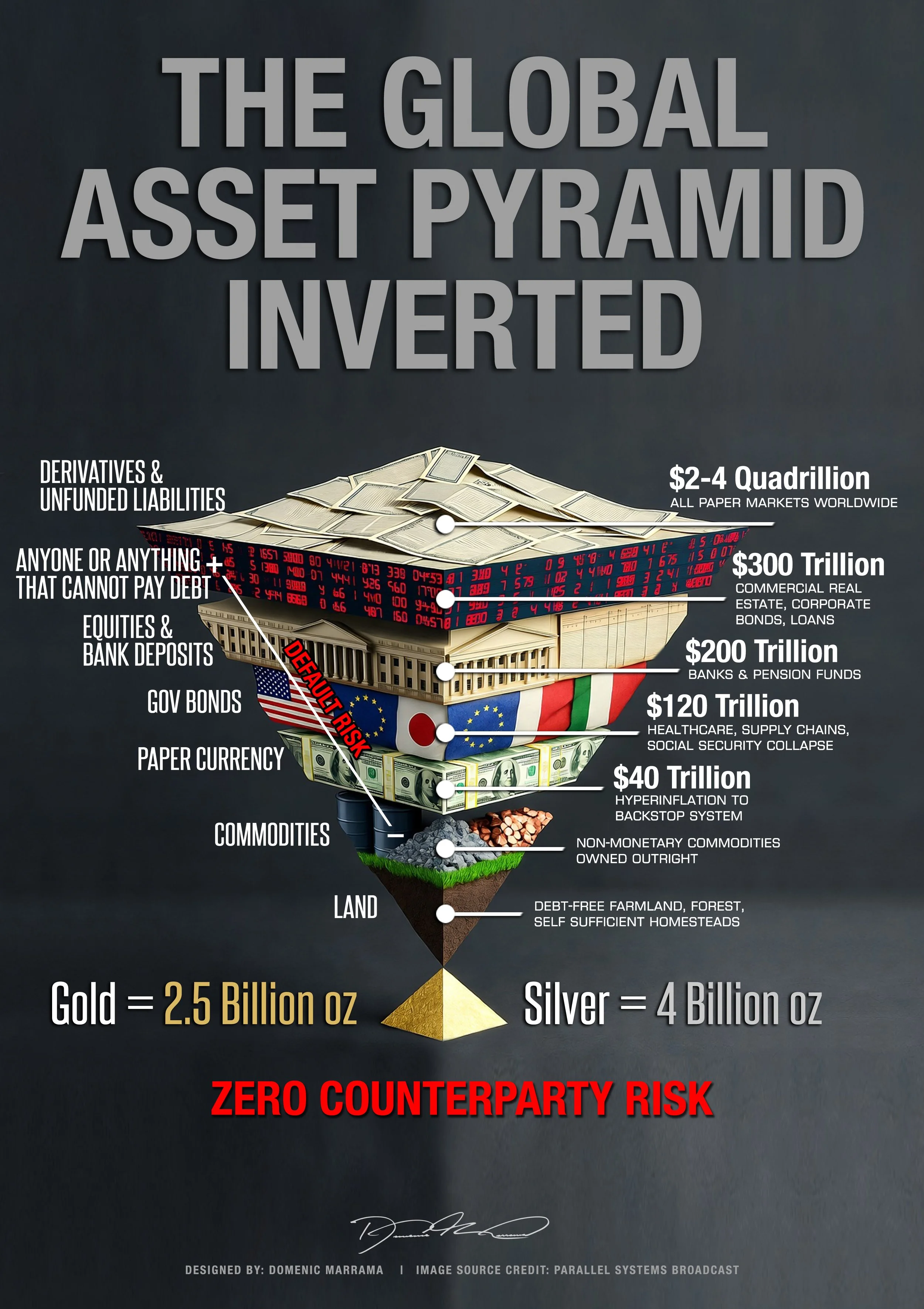

The Architectural Hierarchy of Trust

This image is a map of the global financial system.

The vast, teetering top is the world of abstraction and counterparty risk. The narrow base is the bedrock of physical finality.

It illustrates the instinctive flight to safety—the flow of capital from complexity to tangibility during any crisis of confidence.

That small gold pyramid isn't just another layer. It is the irreducible foundation of value upon which the entire structure rests.

-

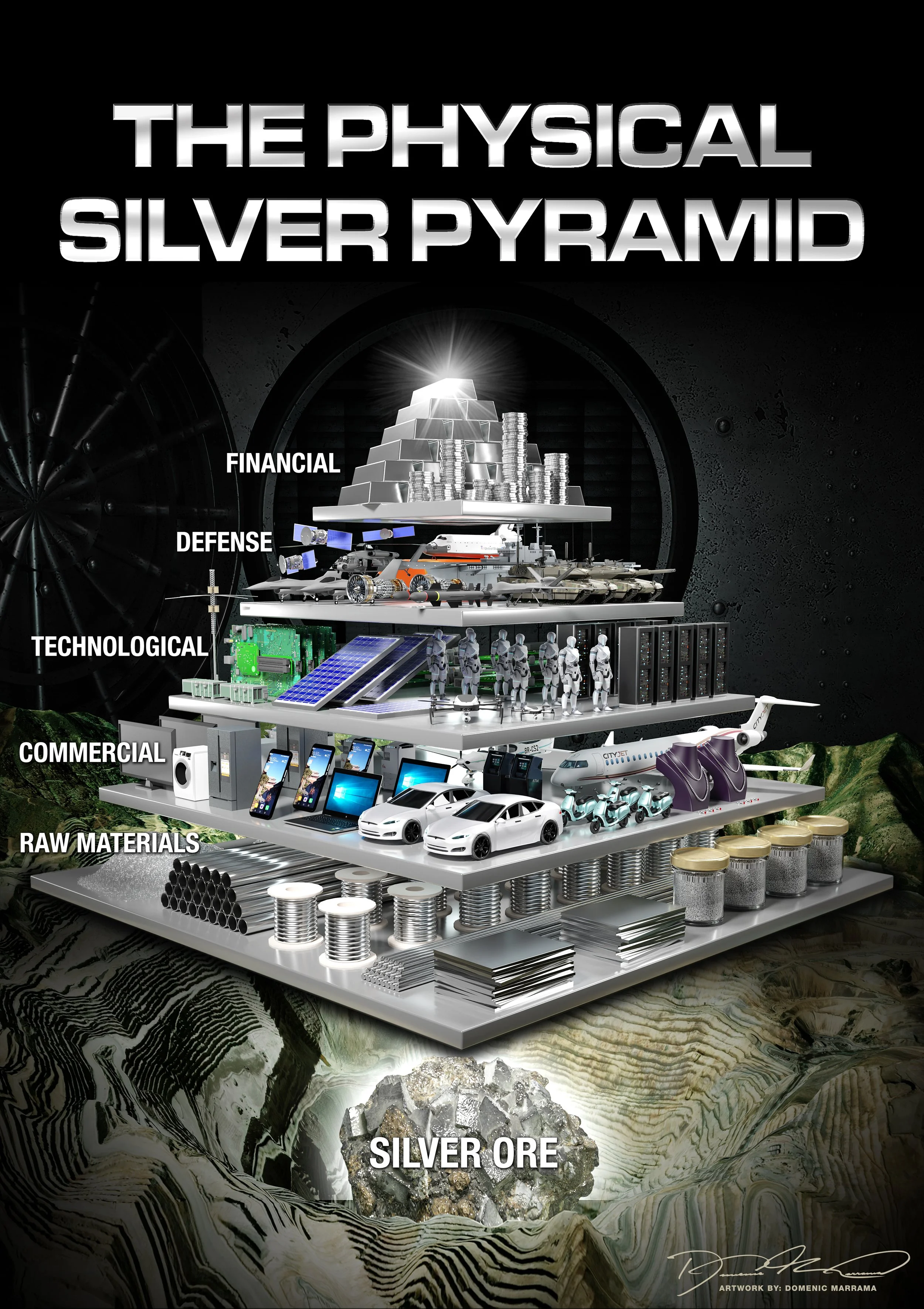

The Architecture of Physical Inelasticity

The Physical Silver Pyramid is an architectural deconstruction of the global economy’s material foundation.

This model tracks silver from its geological origin as raw ore through its transition into the industrial building blocks, consumer infrastructure, and high-spec technology that define the 21st century.

At the apex sits the financial layer—the final refinement of all the value below. This diagram illustrates a fundamental truth: the monetary value of silver is physically tethered to its industrial utility.

If the base of the pyramid narrows, the entire structural stack—from the server room to the vault—is forced into a state of absolute scarcity.

-

Visualizing Scarcity: Every ounce of investment silver on Earth

This visualization bridges the gap between abstract market data and the shocking physical scarcity of silver.

Most people think silver is abundant. But if you gathered every investment-grade silver bar and coin in existence into one solid block, this is the reality:

Total Supply: 4 Billion Troy Ounces (approx).

Total Weight: 124,400 Metric Tonnes.

Visual Scale: A cube just 22.8 meters (75 ft) per side.

Empire State Building:

The entire world supply would be dwarfed by the scale of the building, occupying just a few lower floors.

U.S. Capitol:

The block fits entirely inside the Capitol Rotunda, with room to spare.

Why is it so small?

Unlike gold, which is hoarded and recycled, silver is an industrial metal. Over 50% of all silver ever mined has been "consumed"—used in electronics and discarded in landfills.

While gold stays above ground, silver disappears.

Does the price reflect this level of scarcity?

-

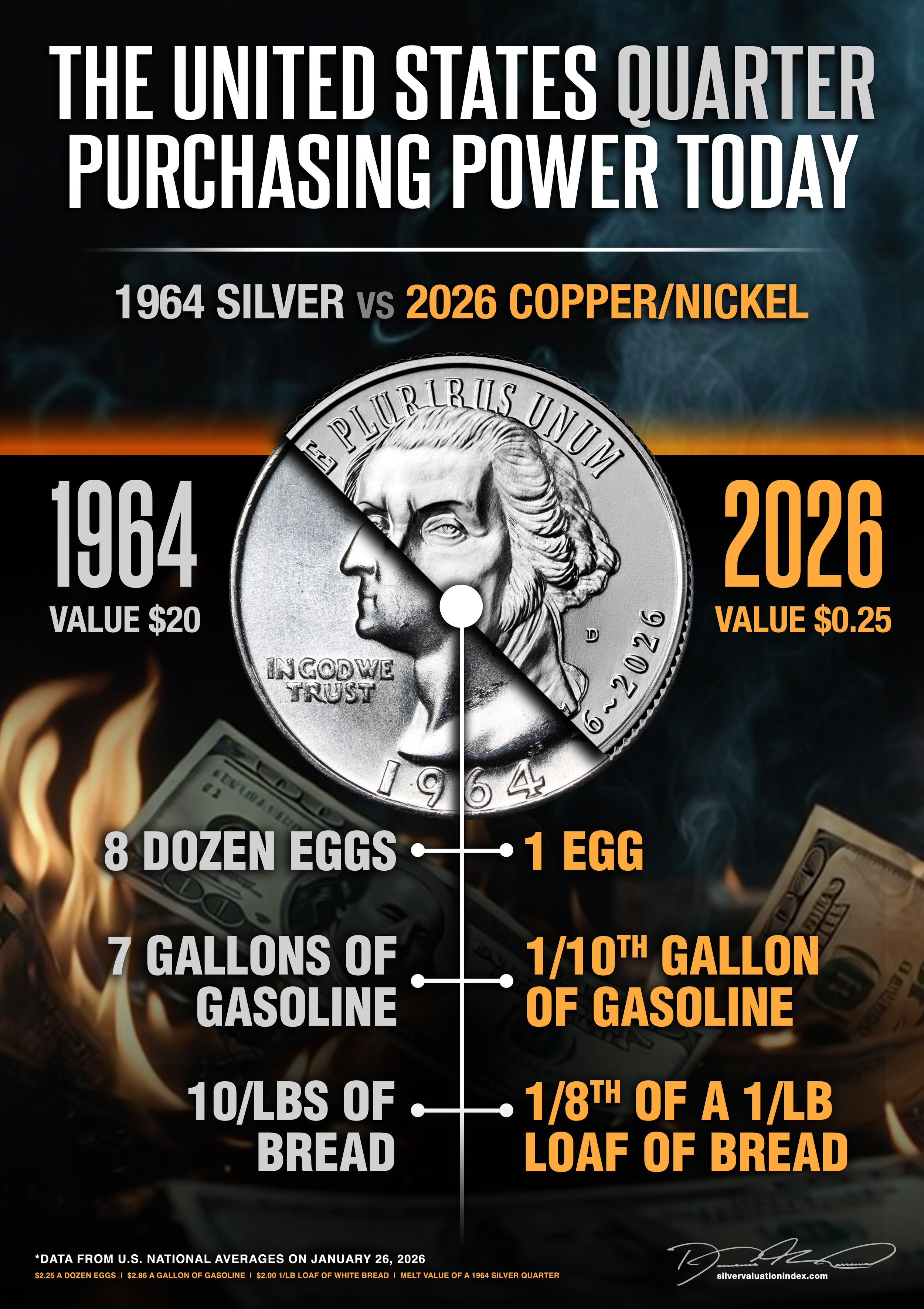

The Hidden Cost of Removing Silver: How Currency Debasement Hollowed an Economy

In 1964, a single U.S. quarter — backed by real silver — could buy:

• 8 dozen eggs

• 7 gallons of gasoline

• 10 pounds of bread

In 2026, that same quarter — now copper and nickel — buys:

• 1 egg

• 1/10th of a gallon of gasoline

• 1/8th of a loaf of bread

This is not “inflation.”

This is monetary debasement.

The metal was removed. The purchasing power followed.

What we’re witnessing isn’t a slow erosion — it’s a systemic failure of the unit of account. When currency loses its physical anchor, it becomes a political instrument instead of a store of value.

And here’s the part nobody wants to say out loud:

The loss of silver from U.S. coinage didn’t just weaken the dollar — it weakened the entire industrial base that depends on silver for electronics, defense, energy, aerospace, and infrastructure.

You can’t hollow out a monetary metal and expect industrial resilience.

This graphic isn’t nostalgia.

It’s a warning.

A nation that trades real metal for printed trust eventually trades sovereignty for supply chains.

And when the metal is gone, price doesn’t matter anymore — access does.

-

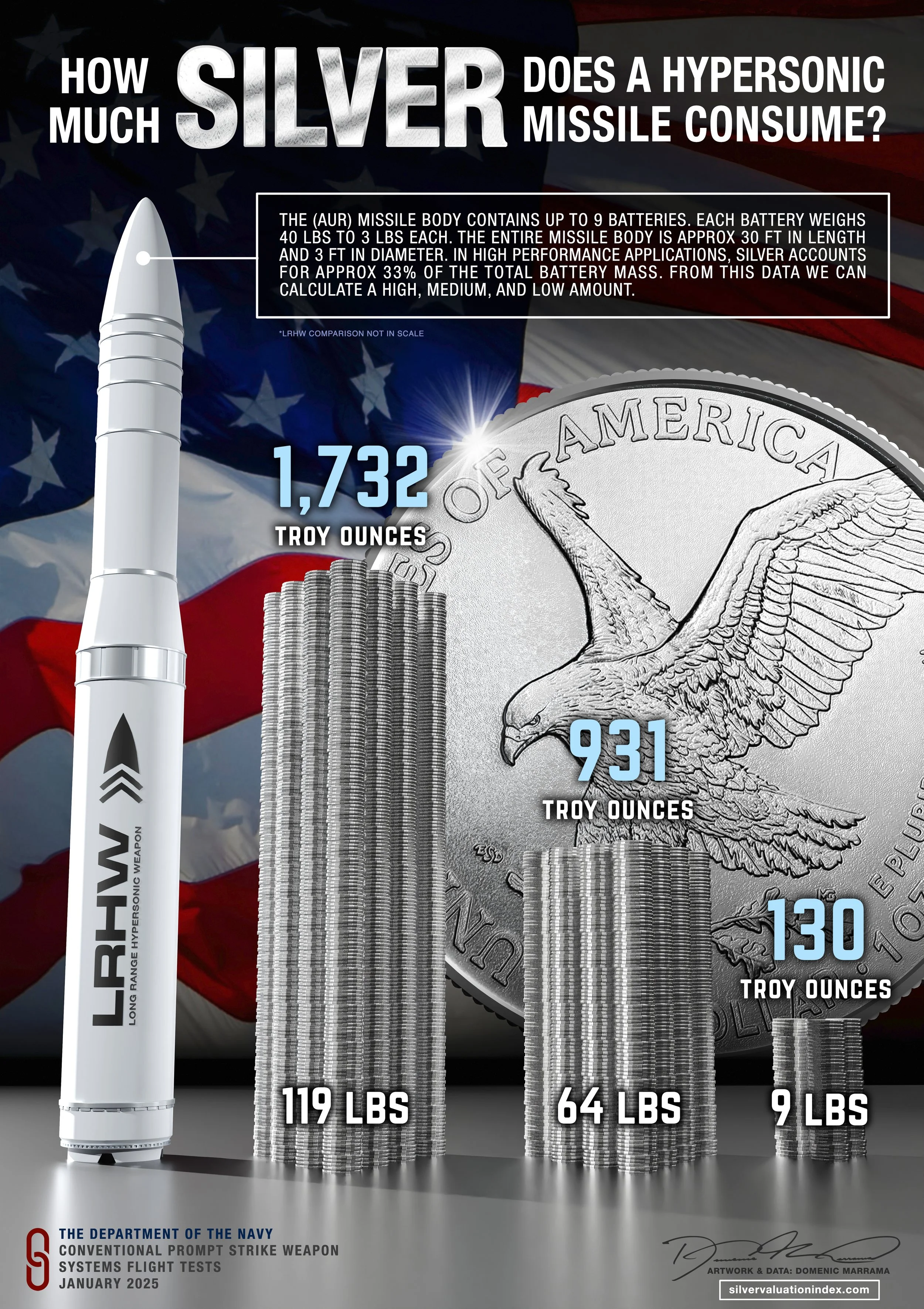

If the Vault is Empty, the Spear is Broken: The Hypersonic Silver Reckoning

The more "advanced" our weapons become, the more "elementally dependent" we are on materials we no longer control.

In January 2025, the Department of the Navy released a technical blueprint for the most resource-intensive weapon system in history. Buried within the Final Environmental Assessment for the Conventional Prompt Strike (CPS) and LRHW systems is a physical requirement that exposes a massive, uncalculated chokepoint in the global silver market.

The Energy-Mass Penalty: The Cost of Mach 5

To jump from the 570 mph of a subsonic Tomahawk to the 3,800 mph of the LRHW, the military has accepted a staggering "Energy-Mass Penalty." At hypersonic speeds, the vehicle must move flight control surfaces and keep sensors operational under crushing heat and G-forces. Standard batteries cannot survive this. The solution revealed in Table 2.1.1-1: Up to 9 high-output Silver-Zinc (Ag-Zn) batteries per missile.The Elemental Audit: The New Benchmark

Forget the widely circulated claim of 500 ounces of silver in a Tomahawk. That number is now an obsolete relic. By performing a forensic review of the Navy’s 2025 specifications and applying the 33% elemental silver ratio required for high-performance Ag-Zn flight cells, I have reconstructed the hidden physical cost of the LRHW system:Upper Limit: 1,732 Troy Ounces per missile.

Median Requirement: 931 Troy Ounces per missile.

Lower Limit: 130 Troy Ounces per missile.At the high end, a single LRHW launch consumes as much silver as four Tomahawk missiles combined.

The One-Way Trip: Permanent Depletion

The Navy document adds a layer of terminality to this math. These are flight tests. These vehicles are designed to launch, maneuver at Mach 5, and then—as the document explicitly states—"fall into the ocean." This is not a rechargeable loop. This is the permanent, kinetic consumption of 1,700 ounces of silver per shot, dumped into the abyss of the Pacific.The Conclusion: Rebuilding a Vault in a "Sold Out" Market

The LRHW is the tip of the American spear. While the recent "Critical Mineral" designation allows the U.S. to finally begin rebuilding its stockpile, they are attempting to buy back the insurance policy after the house has already caught fire.We have moved from "Smart Weapons" to "Resource-Intensive Weapons," and the future of speed weighs 1,732 ounces of silver per trigger pull. In the age of the LRHW, I suspect the market moves little by little—then hits hypersonic speed toward a global "Sold Out" event.

If we do not own the silver, we do not own the sky. 🦅

See page 30 of the Navy’s own Environmental Assessment for the Conventional Prompt Strike / LRHW program, which documents the physical battery requirements used in my analysis:

The Velocity of Money Psychology Index

Visualizing the Global Migration from Fiat Currency to Hard Assets

CHART CREATED BY: DOMENIC MARRAMA©

Global Silver Trends

Search Volume Index (0-100)

CHART CREATED BY: DOMENIC MARRAMA©

Industrial Silver Demand

Weekly Search Volume Index (0-100)

CHART CREATED BY: DOMENIC MARRAMA©

Global Silver Mine Production

Metric Tons per Year (1994 - 2024) | Source: USGS

CHART CREATED BY: DOMENIC MARRAMA©

Add Holdings

Portfolio Performance

Inventory Log

| Date | Type | Weight (oz) | Qty | Total Oz | Cost Basis | Cost/Oz | Action |

|---|

Presidential National Debt Timeline

CREATED BY: DOMENIC MARRAMA ©

Gold : Silver Ratio Timeline

CREATED BY: Domenic Marrama ©

Ag/Cu/Au Comparative Physics Engine

Atomic Performance & Industrial Utility MatrixDoD Rare Earth Elements in Defense-Critical Sectors

GRID: ACTIVE

The Periodic Table of Silver

Alloys, Compounds, and Military Applications

Fine Silver

Pure ElementPure elemental silver. It has the highest electrical conductivity, thermal conductivity, and reflectivity of any metal. Too soft for most functional objects.

The Death of Money

Eggflation: Hyper-Inflation Simulator

100 People: 94 Consumers, 5 Farmers, 1 Grocer.

Supply: 10,000 Eggs. Start: Everyone has $100.

CREATED BY: DOMENIC MARRAMA©

Time Since Last Full U.S. Gold Audit

Counting the time since the last independent, physical verification of the Fort Knox Gold Reserves.

Silver Intelligence Directory

A curated index of macro-economic thinkers, analysts, media, and mining producers.

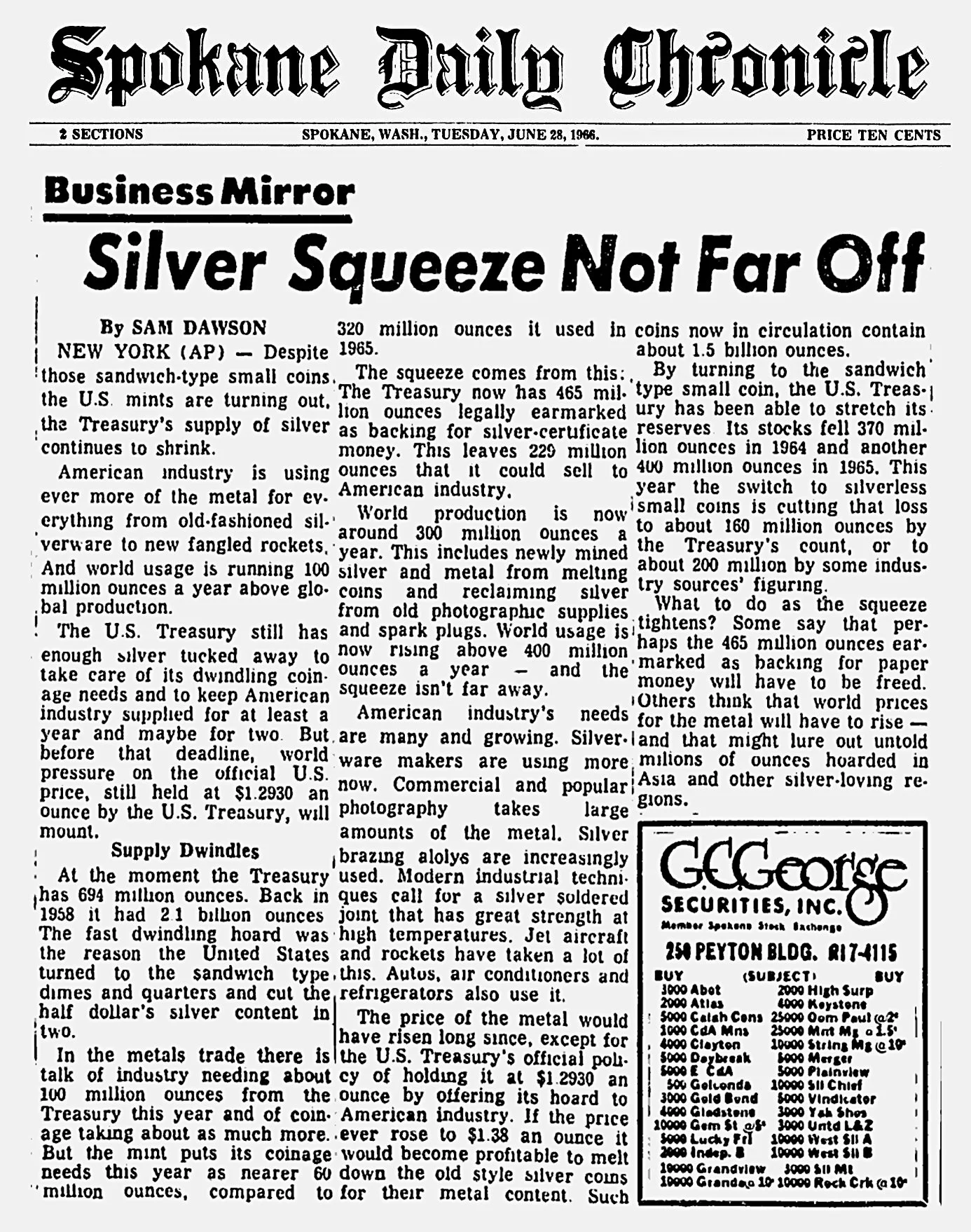

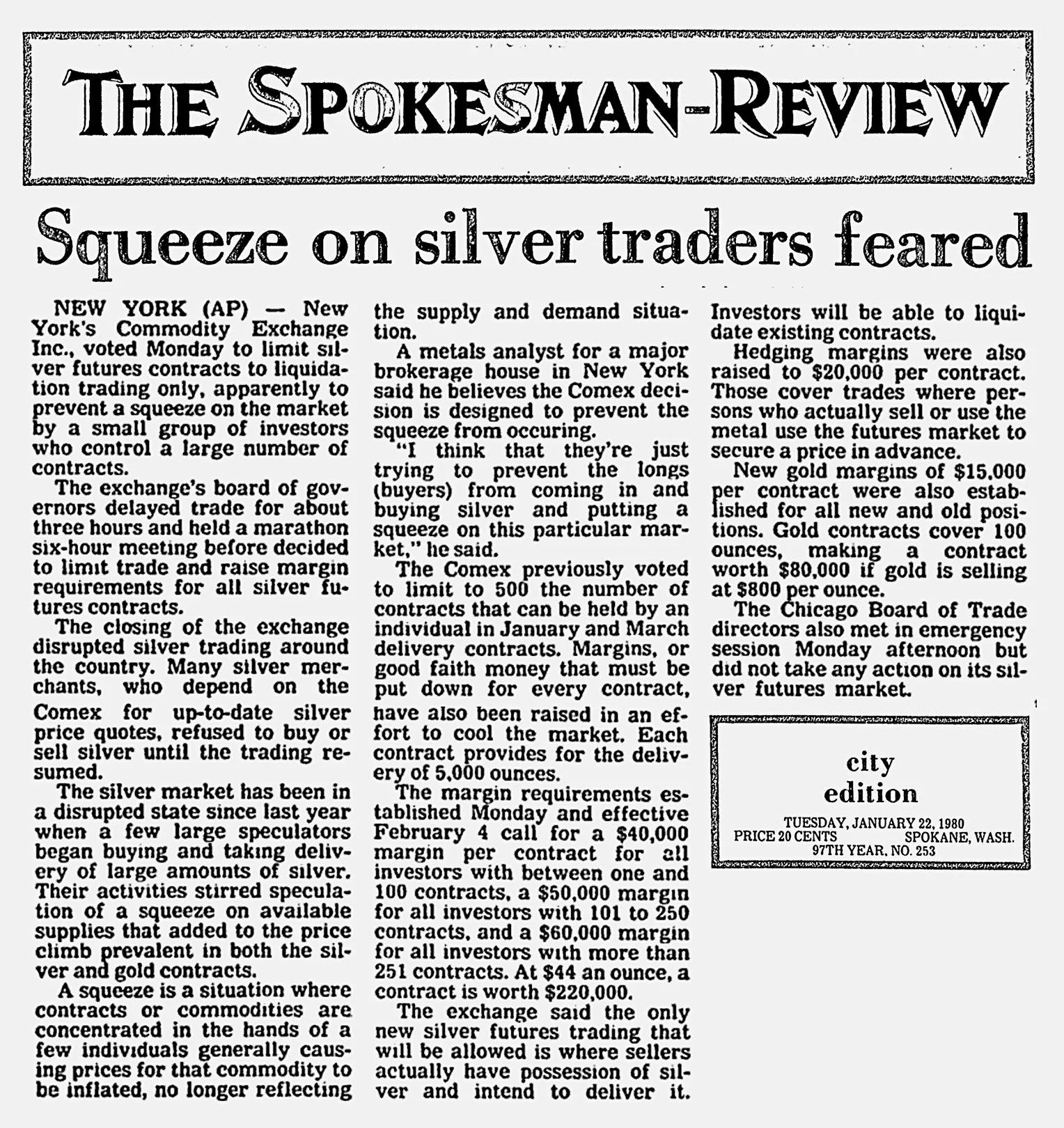

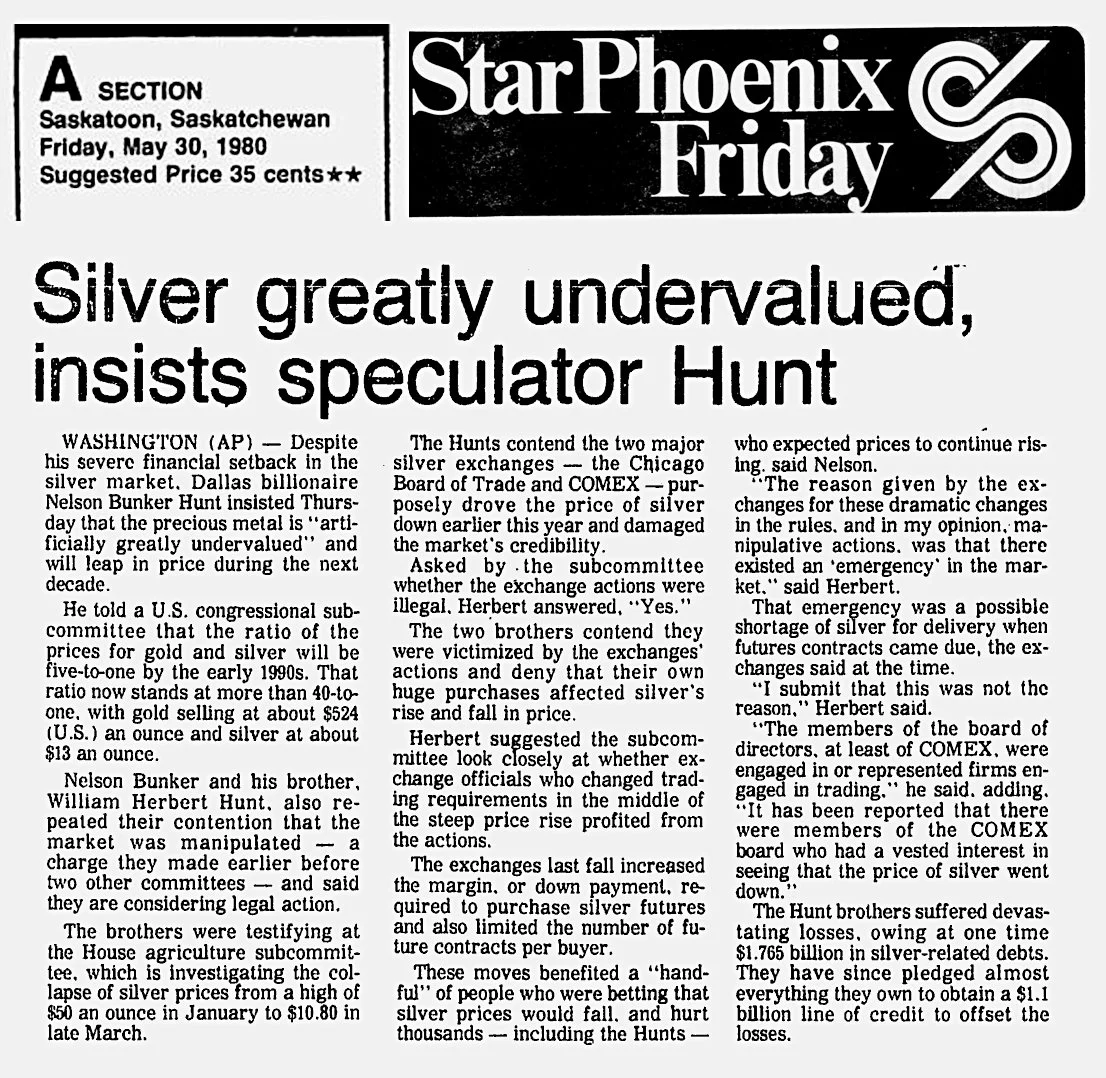

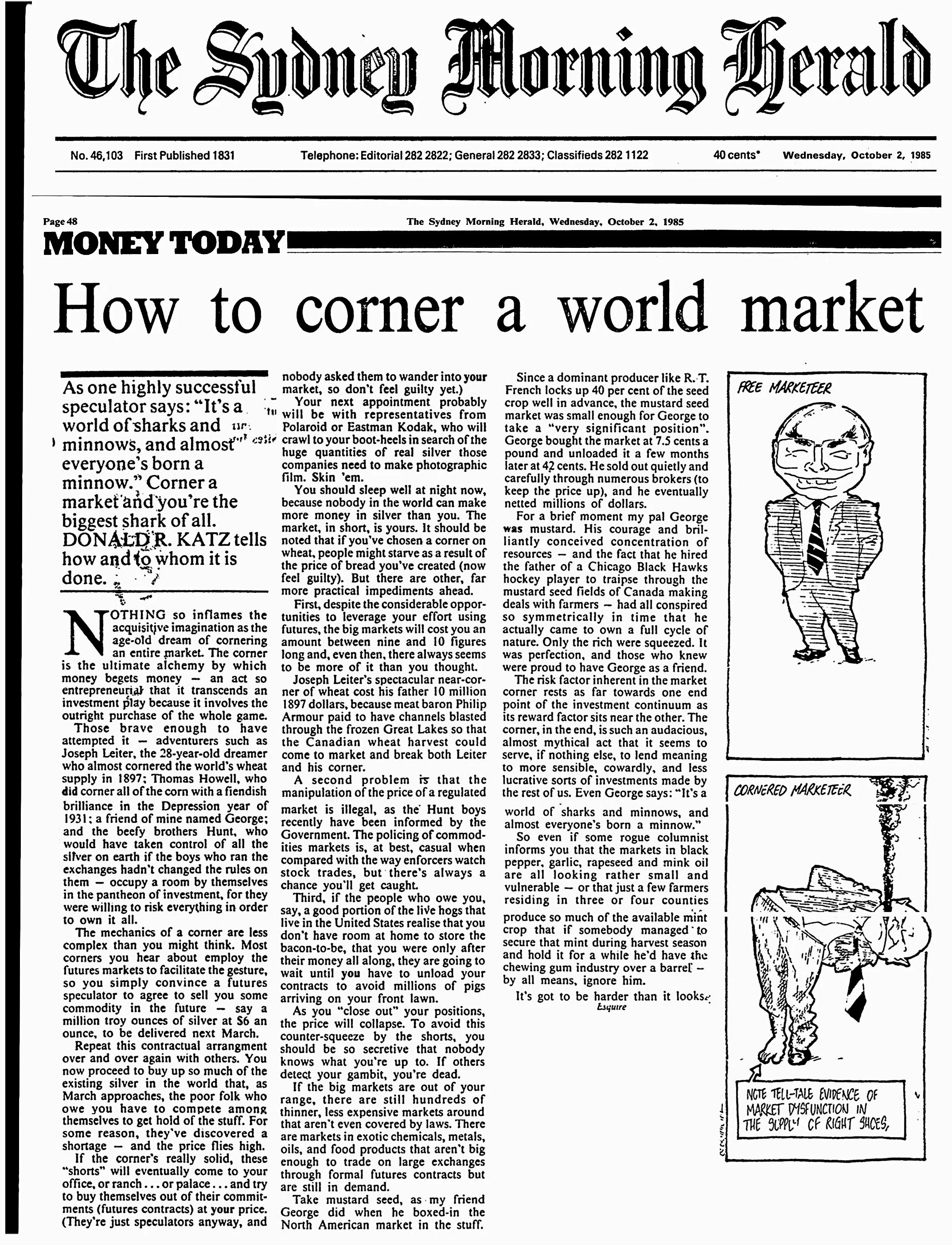

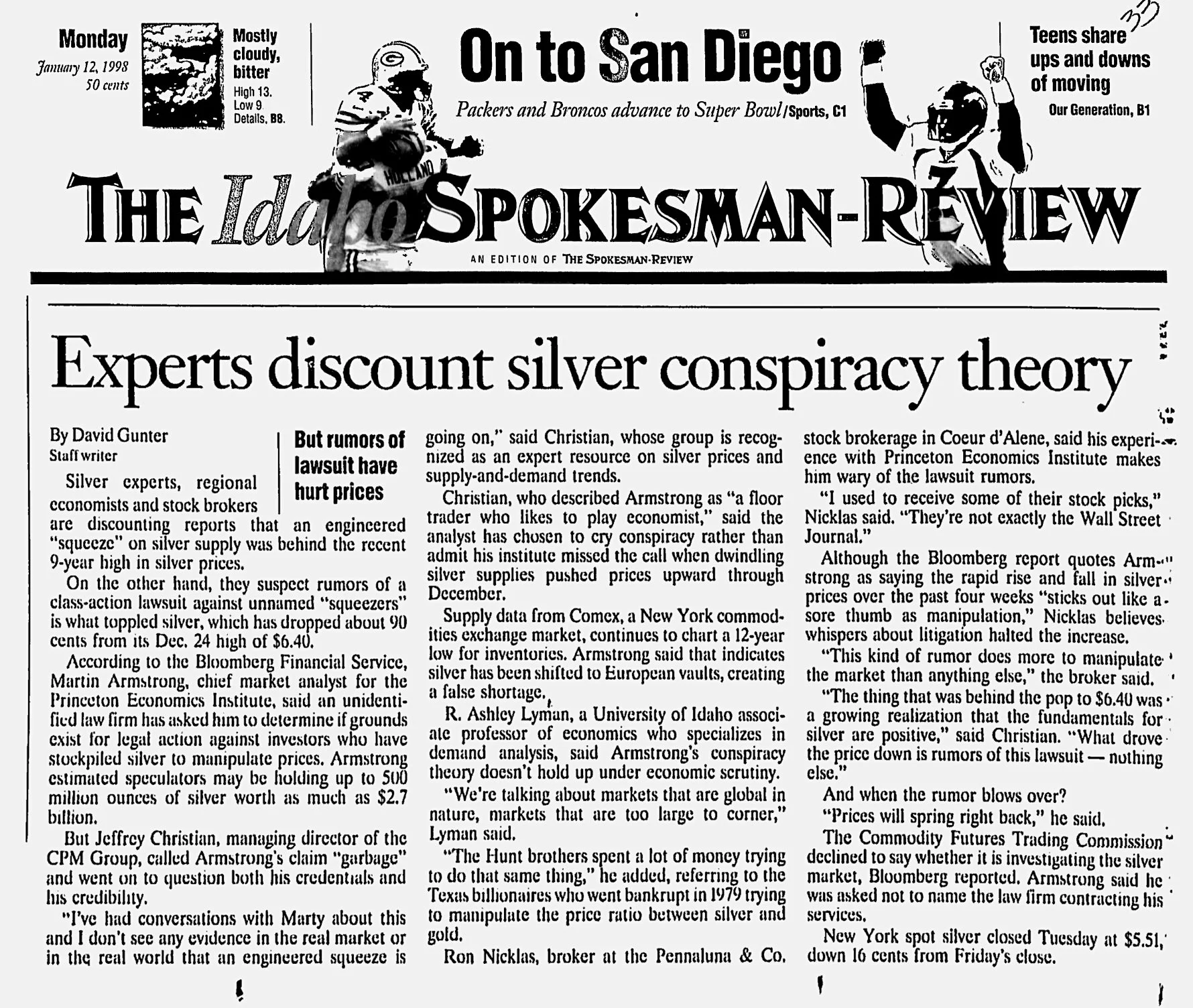

The 1980 Corner Was Analog. Today’s Market Is Digital.

In 1980, the Hunts accumulated silver using a system that now looks prehistoric:

- Phone calls

- Manual brokerage orders

- Warehouse receipts

- Physical settlement practices

- Localized liquidity

It was a world with:

- No ETFs

- No high-frequency trading

- No globalized 24/7 markets

- Minimal derivatives

- Limited cross-exchange coordination

Yet even with that primitive infrastructure, two men triggered:

- a 10× price spike

- COMEX emergency rule changes

- banking-sector instability

- global margin crises

- a full-on monetary panic

Now compare that to today’s architecture:

- Hyper-connected global markets

- Algorithmic liquidity

- Massive ETF-based metal claims

- Multi-layered derivatives

- Rehypothecated unallocated pools

- 24/7 international market access

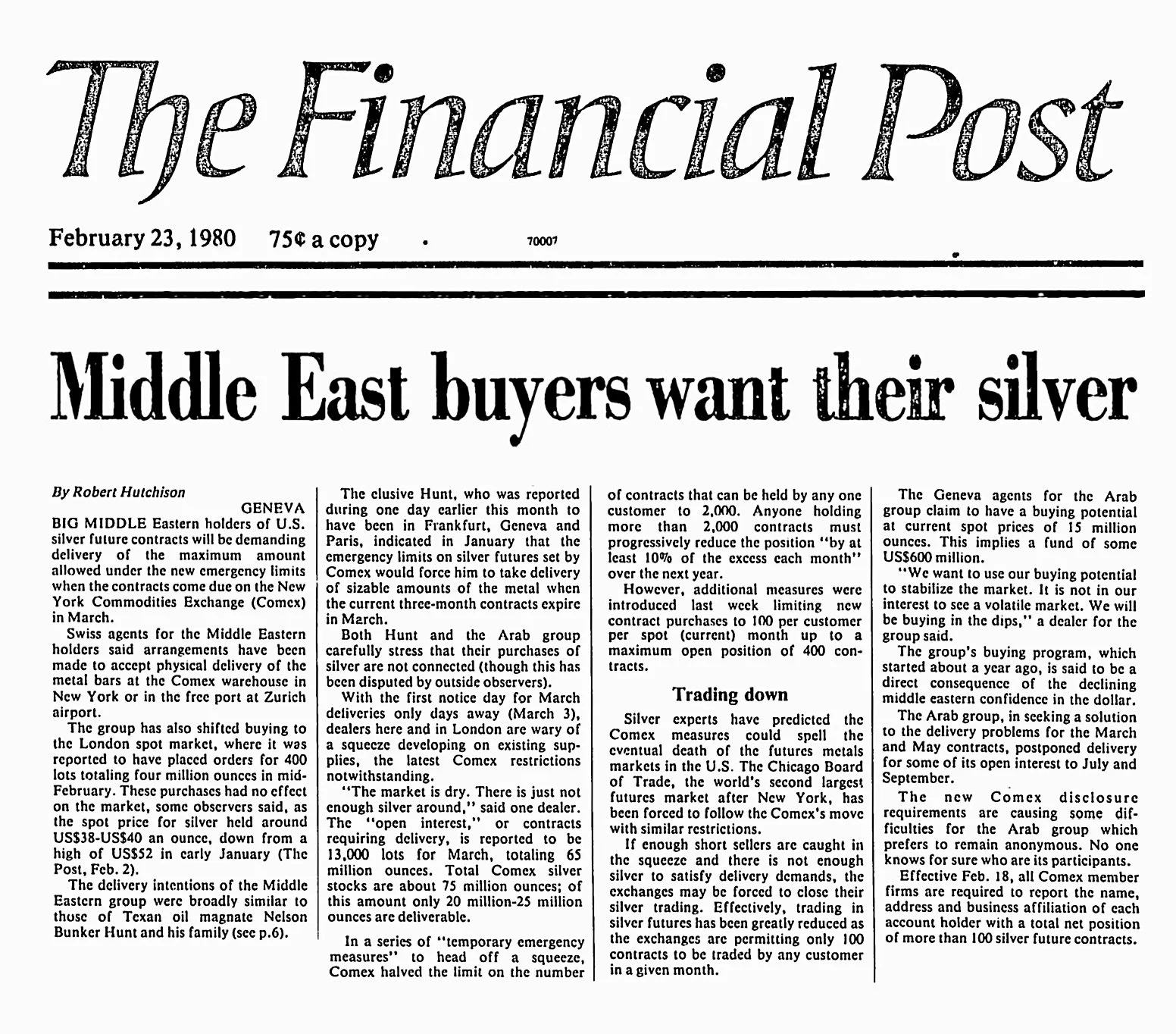

The 1980 Corner Was Physical. Today’s Corner Would Be Informational.

The Hunts had to:

- buy physical metal

- take delivery

- store bars

- hide their positions

- coordinate through intermediaries

- operate largely in the dark

In 2025, none of this is necessary.

The fragility today is informational, not logistical.

The moment the public recognizes:

- low vault inventories

- unprecedented paper-to-physical ratios

- structural supply deficits

- rehypothecated obligations

- industrial consumption outrunning mining

- ETF redemption liabilities

- shrinking above-ground stockpiles

…the pressure becomes self-reinforcing.

A modern “corner” doesn’t require buying the metal. A modern corner is triggered by awareness.

This is the most explosive shift from 1980 to today.

And this is precisely what tools like the Silver Valuation Index visualize: the mismatch the system relies on the public not noticing.

The Modern Silver Market Is Far More Leveraged - to an Unthinkable Degree

In 1980, leverage was roughly 5:1. Derivatives were simple. Settlement chains were direct.

Today?

Leverage is conservatively estimated at 300:1 to 800:1, built on:

- multiple unallocated pools

- cross-jurisdictional rehypothecation

- ETF custodial webbing

- opaque bullion bank liabilities

- massive derivative layering

- synthetic exposure products

- high-frequency liquidity mirages

- industrial demand that cannot be shut off

If two men almost collapsed a 5:1 system… what happens when the world discovers a system running 800:1?

The math is not complicated. It’s just uncomfortable.

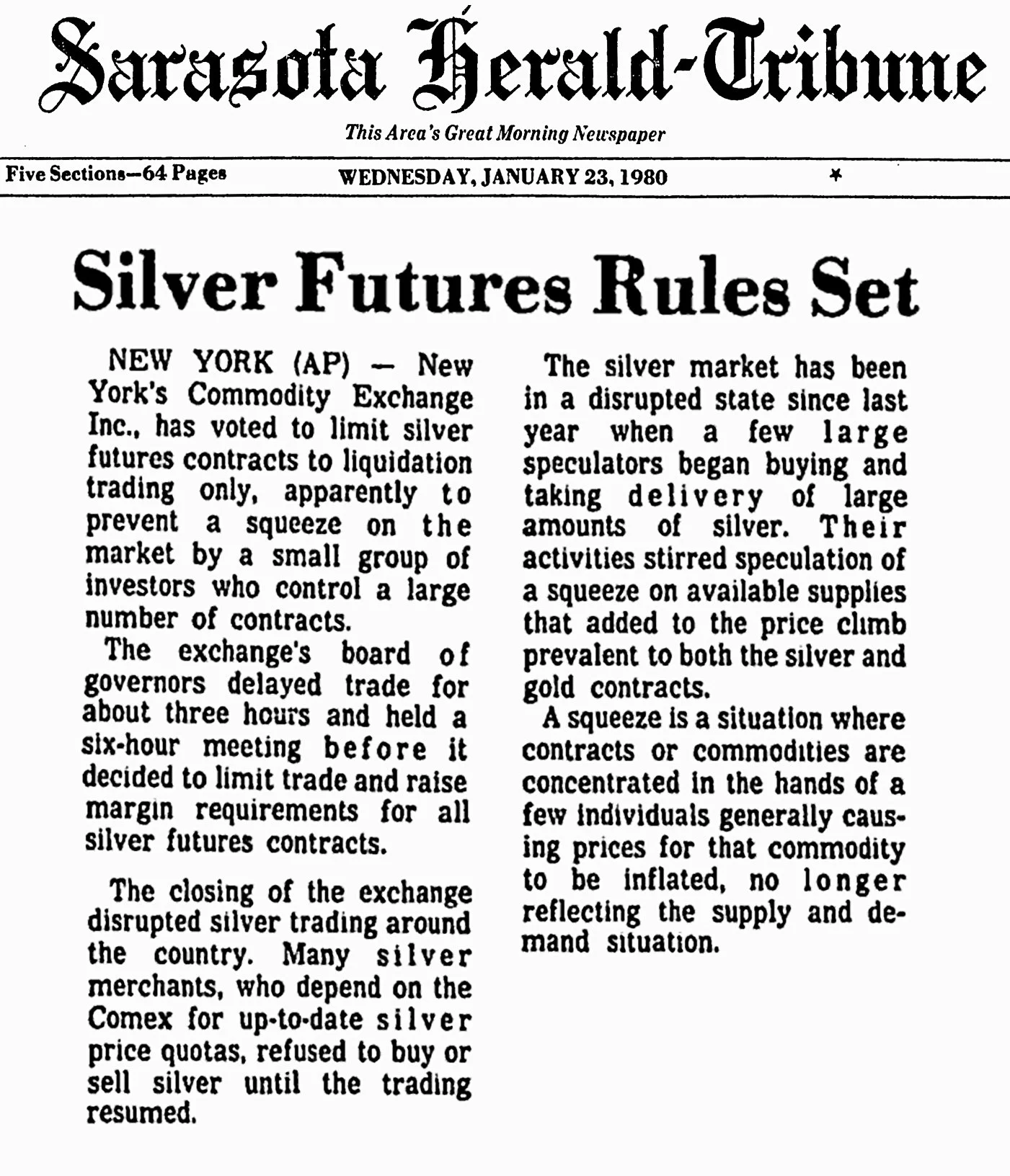

The 1980 Crisis Was “Stopped” With Rule Changes. Today, That Safety Valve No Longer Exists.

In 1980, regulators “saved” the system by:

- raising margin requirements overnight

- restricting buying

- forcing liquidation

- protecting counterparties

- sacrificing the Hunts to preserve the dollar

That was possible because:

- the market was local

- the exchanges were centralized

- foreign participants were minimal

- industrial demand was tiny

- regulators still had authority

In 2025, none of that applies.

A similar stress event today faces:

- Global markets that route around COMEX

- Sovereigns who do not obey U.S. exchange rules

- Industrial users who cannot halt consumption

- ETF structures that must honor redemptions

- Cross-border liquidity that cannot be contained

- Digital trading infrastructure that reacts instantly

The regulator’s lever no longer exists. The “pause button” is gone. The kill switch is disconnected.

The system is too interconnected, too leveraged, and too dependent on synthetic supply.

This is why institutions avoid discussing silver in structural terms.

The True Implication: The Next Corner Is Not a Person — It’s a Math Problem

The Hunts were a spark.

Today’s system is a powder keg.

The modern “corner” does not require:

- coordinated investors

- wealthy players

- conspiracies

- warehouses

- secrecy

- hoarding

It requires only recognition of the following equation:

Above-Ground Supply vs Paper Obligations vs Industrial Demand vs Fiat Debasement

Once this imbalance becomes widely understood, the corner becomes:

- self-triggering

- self-reinforcing

- self-accelerating

The system breaks from the inside out, because the structure itself is unsustainable.

The Silver Valuation Index exposes this mathematically.

The Hunt Brothers Newspaper Archive provides the historical case study.

The combination is uniquely destabilizing to the modern monetary narrative — not because it’s illegal, but because it’s true.

Conclusion: 1980 Was a Warning Shot. 2025 Is the Reckoning.

The Hunt Brothers didn’t “break the rules.” They exposed the fragility of a system built on leverage, assumptions, and opacity.

Today, that system is:

- larger

- more complex

- more digital

- more layered

- more global

- and infinitely more leveraged

This time, it isn’t two men with phone calls and warehouse receipts.

This time, the pressure comes from:

- math

- information

- transparency

- global demand

- real-world industrial necessity

- and a public increasingly skeptical of paper claims

1980 was the spark. 2025 is the powder keg.

The world just hasn’t realized it yet.

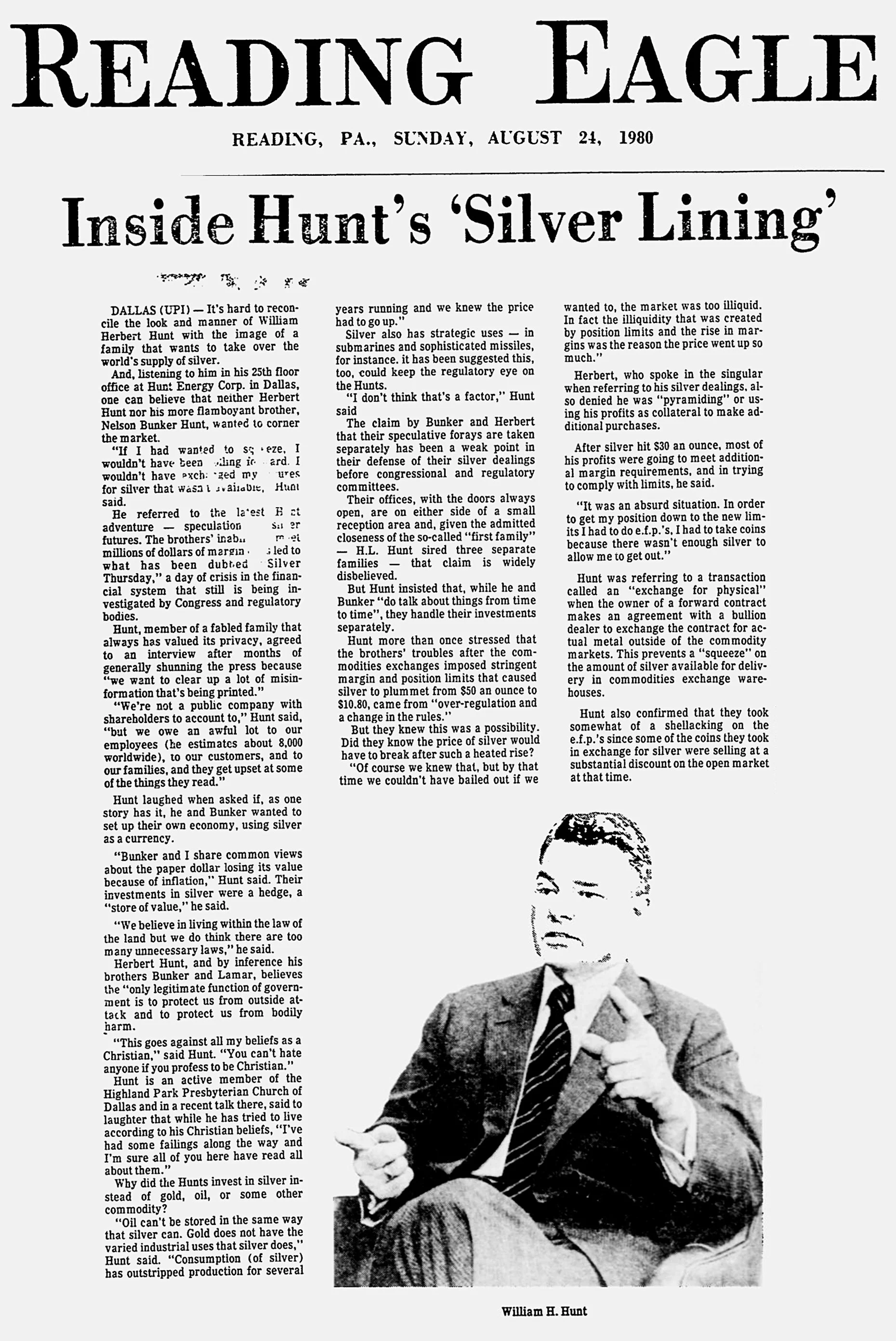

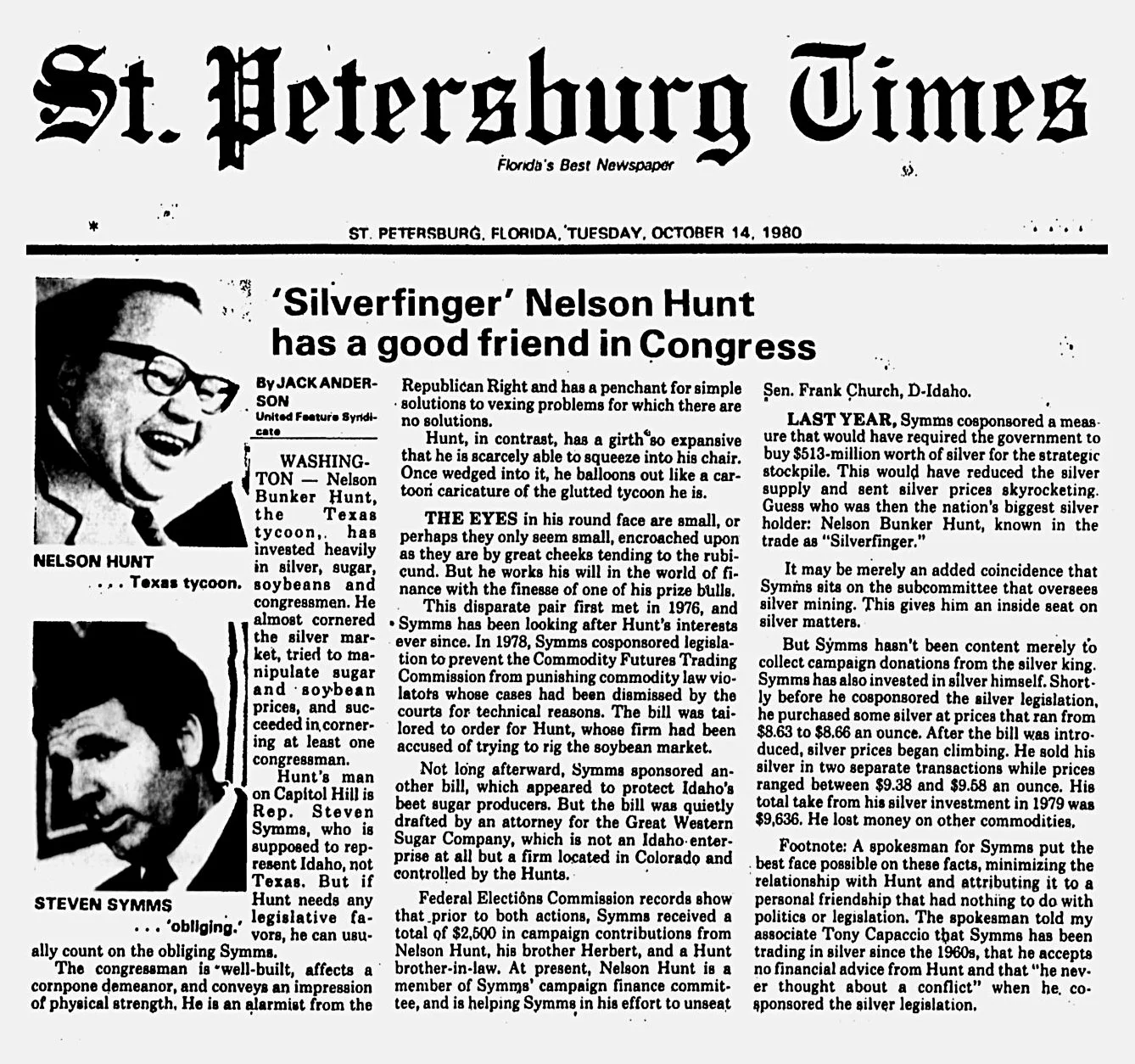

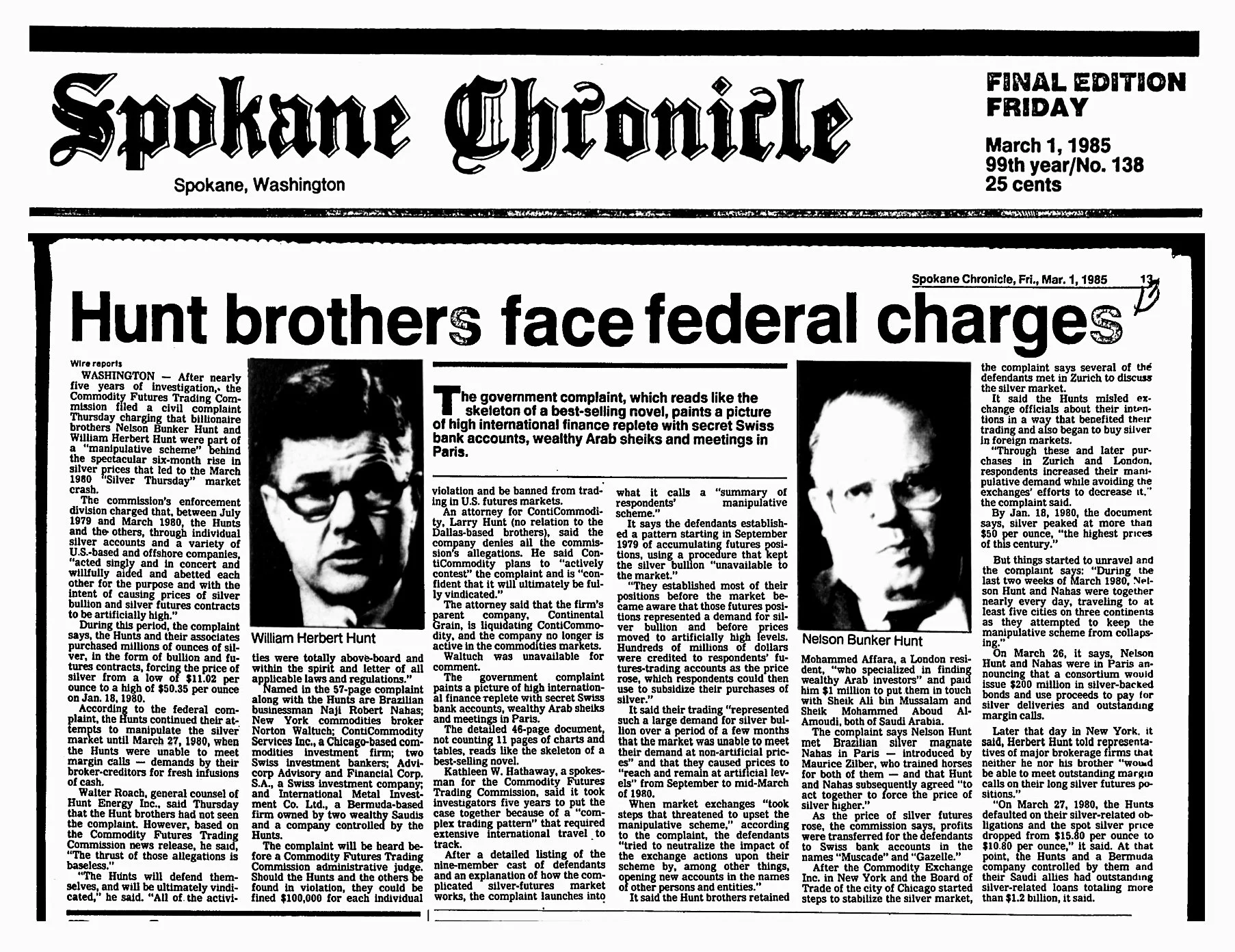

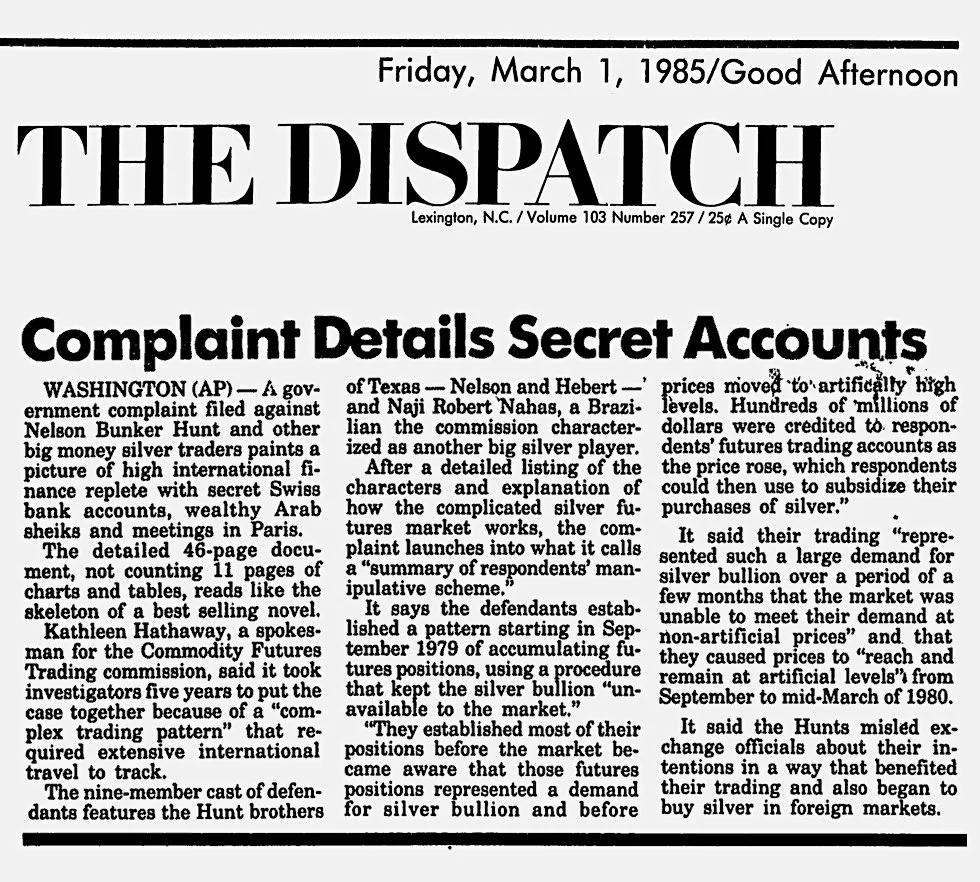

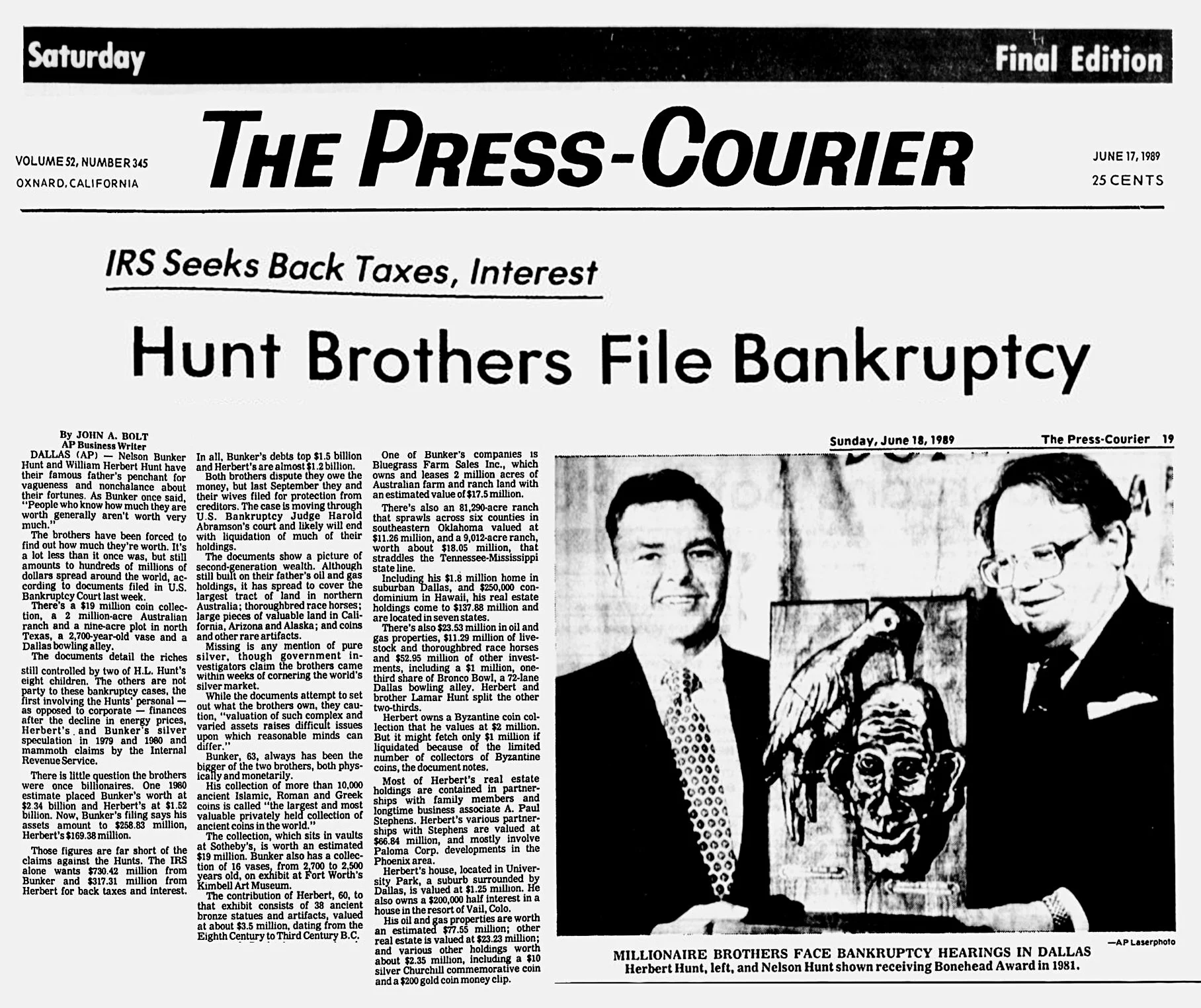

The Hunt Brothers Archive

Primary source documents from the Silver Crisis (1966 - 1998).

ARCHIVE COMPILED BY: Domenic Marrama

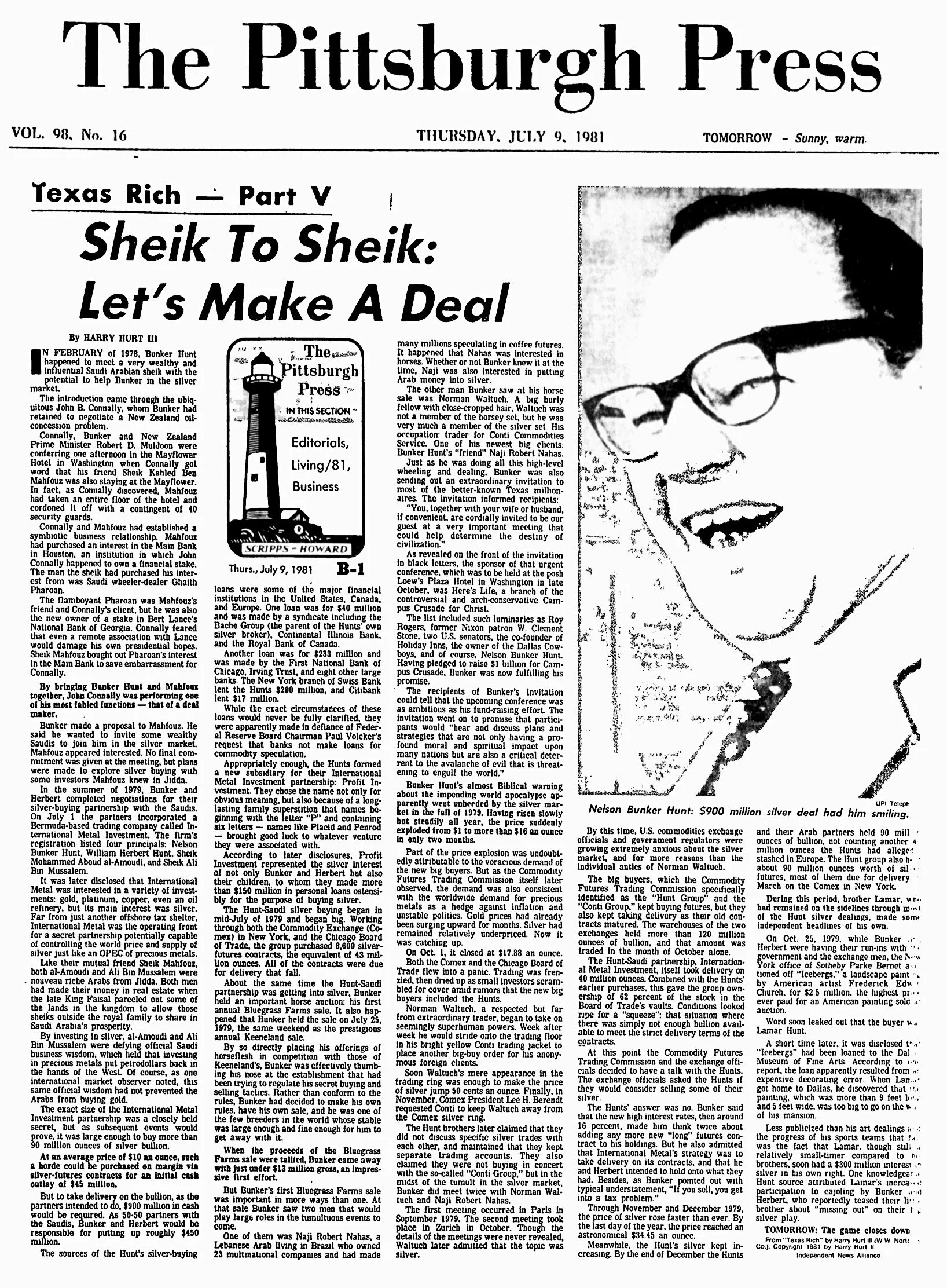

Observer Reporter

"Silver Trading Rule Altered To Prevent Market Squeeze"

Open Newspaper

Lodi News Sentinel

"Millions in silver losses - Hunts' deny manipulation bid"

Open Newspaper

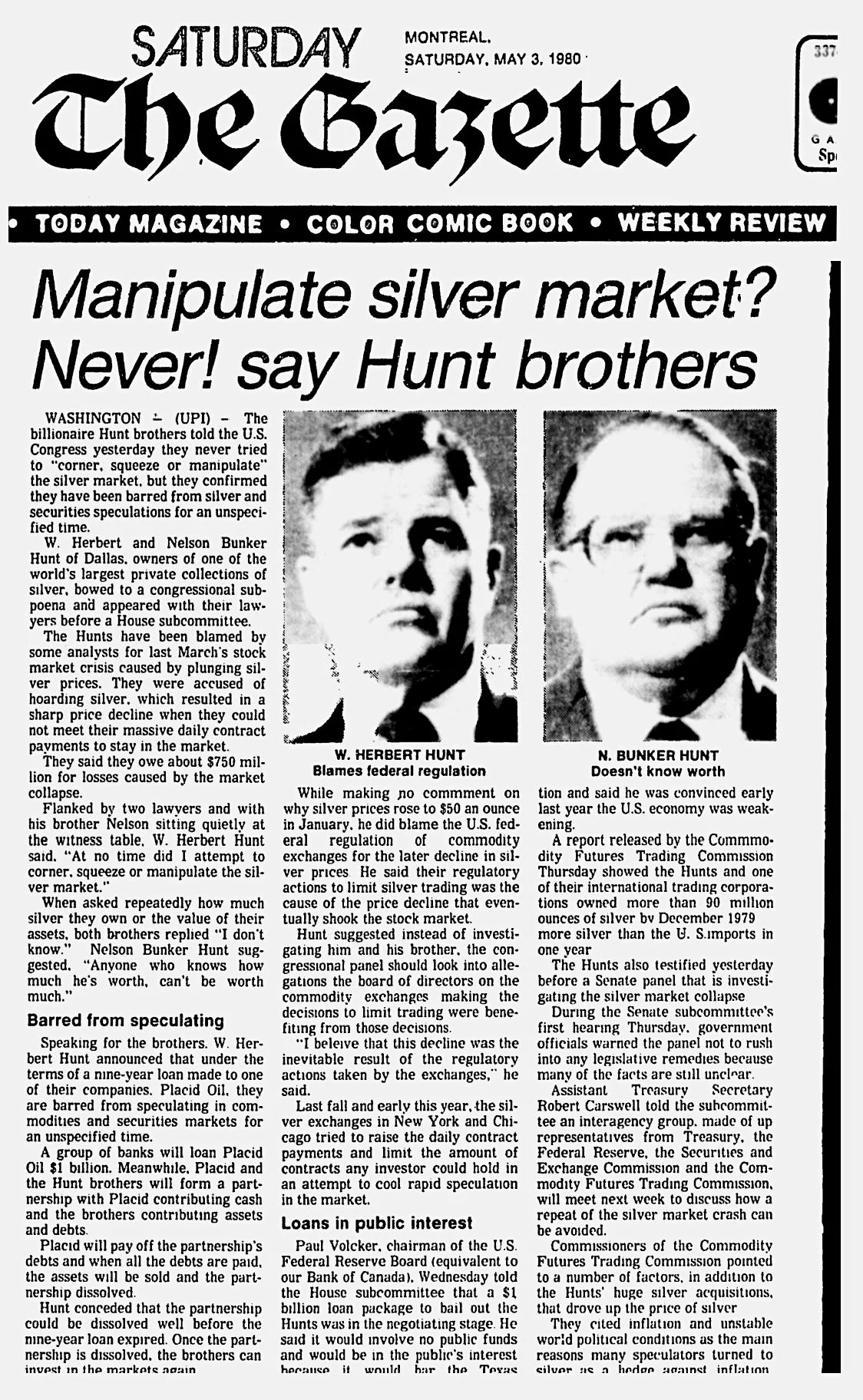

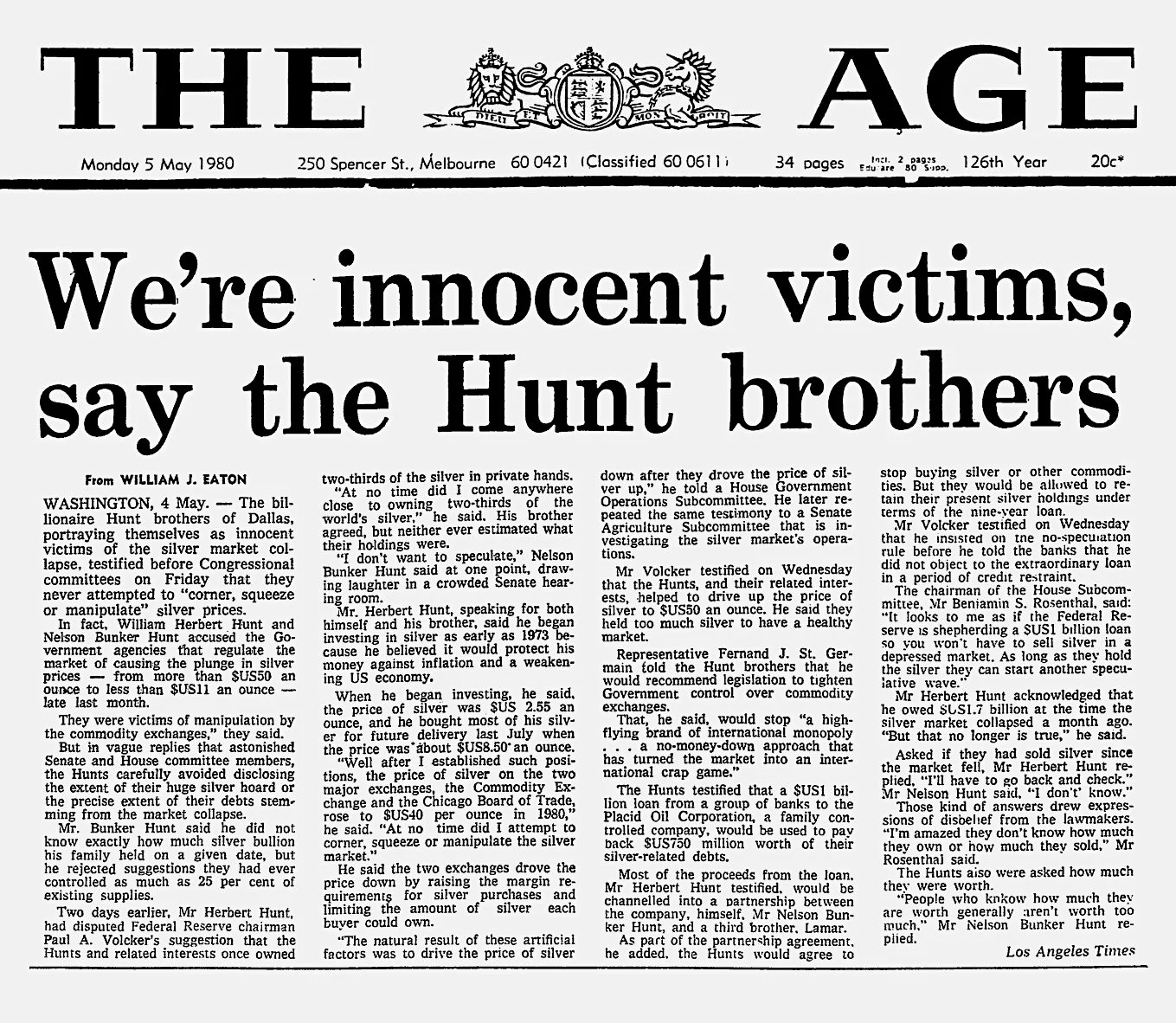

The Press Courier

"Manipulator Roles Denied - Hunts Claim Silver Victimization"

Open Newspaper

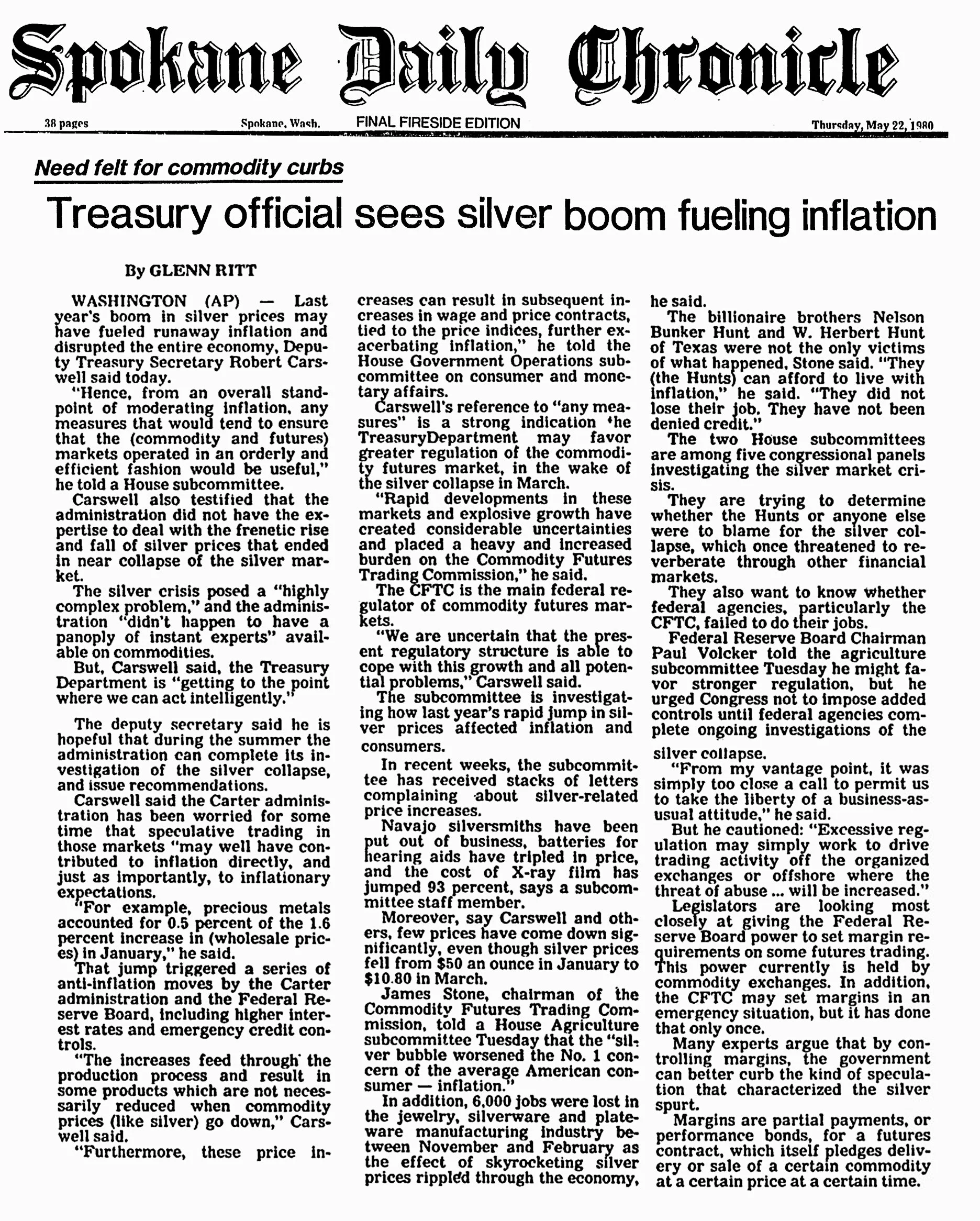

Spokane Daily Chronicle

"Need felt for commodity curbs - Treasury official sees silver boom fueling inflation"

Open Newspaper

The Bonham Daily Favorite

"The Hunts: Their public image and the Gospel according to Herbert Hunt"

Open Newspaper

St Petersburg Times

"'Silverfinger' Nelson Hunt has a good friend in Congress"

Open Newspaper

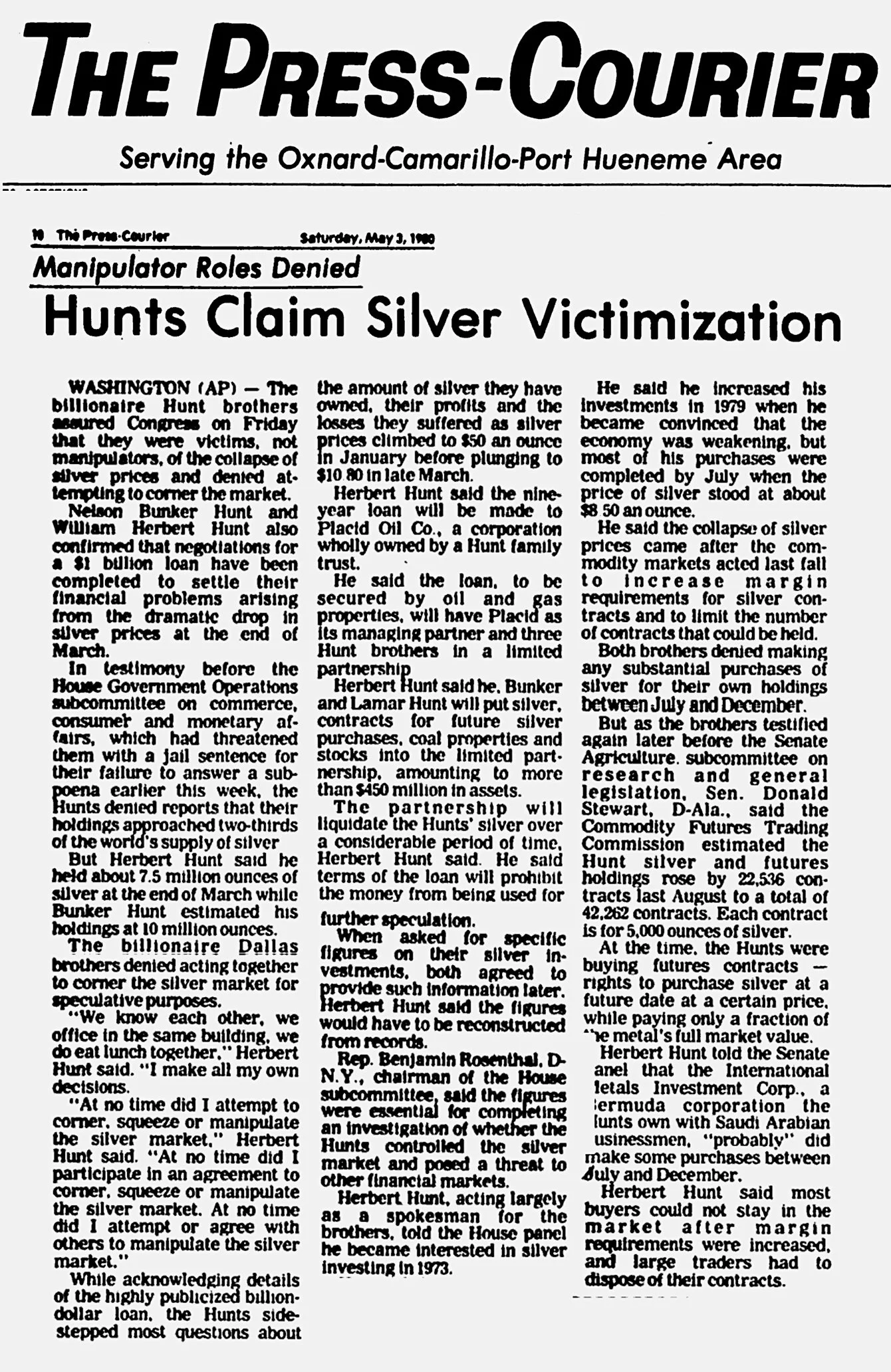

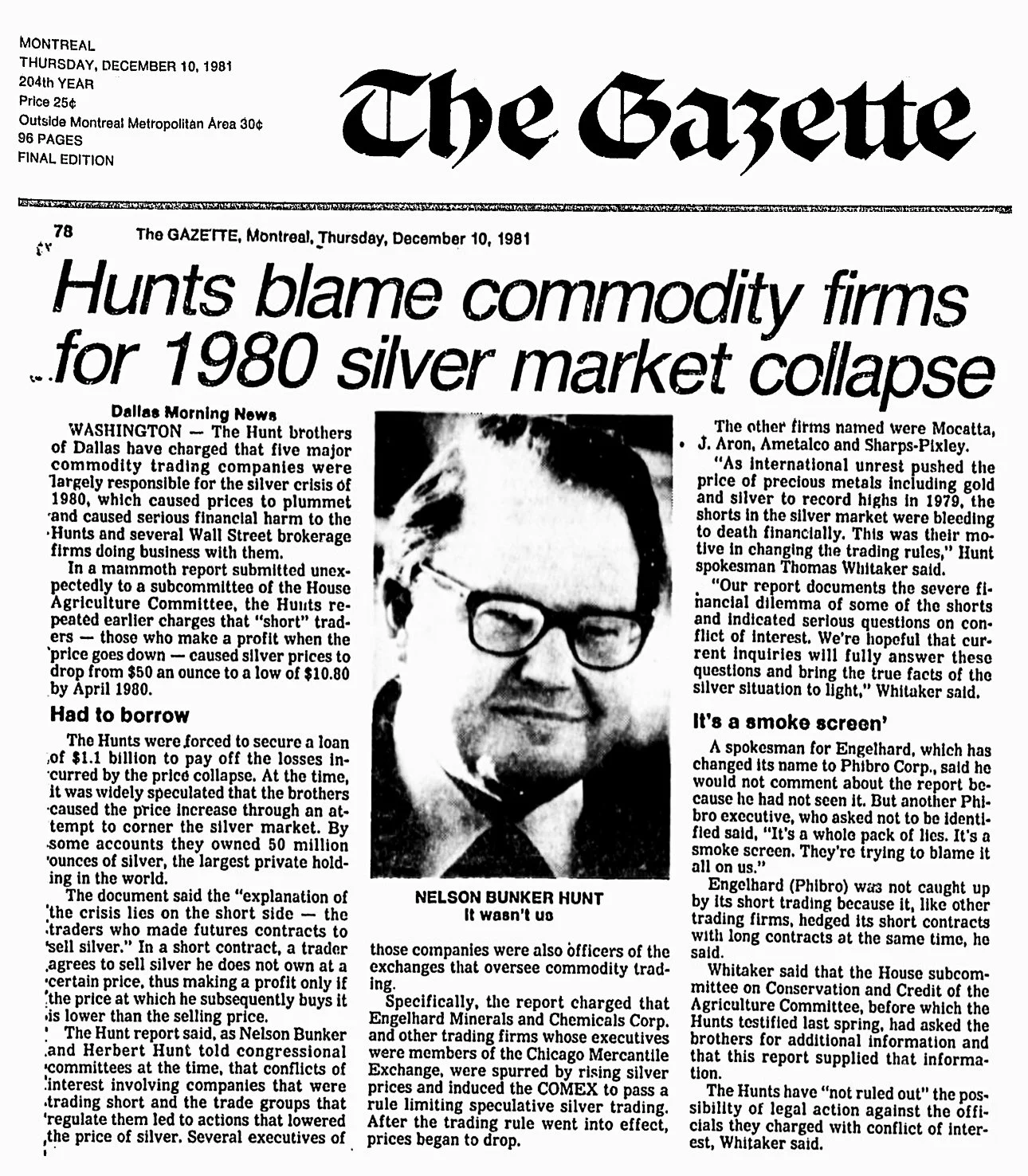

The Montreal Gazette

"Hunts blame commodity firms for 1980 silver market collapse"

Open Newspaper

The Chinese Silver Archive

A Masterclass in Wealth Transfer: Primary source documents detailing the U.S. drain of China's physical silver reserves (1931 - 1945).

ARCHIVE COMPILED BY: Domenic Marrama

The Florence Times-News

"Senators to Study Silver Depression: The Political Origins of the Drain."

Open Newspaper

Rochester Evening Journal

"Silver Drops in China Fear of Embargo: U.S. Policy Hits the Chinese Pocketbook."

Open Newspaper

The Lodi Sentinel

"China’s Silver: Higher Domestic Prices and Diminished Purchasing Power."

Open Newspaper

The Gazette (Montreal)

"China to Check Silver Export: Ten Per Cent Tax Imposed as U.S. Refuses to Halt Purchases."

Open Newspaper

The Vancouver Sun

"Shanghai Reaction: People Hoard Silver as Bank Notes Lose Credibility."

Open Newspaper

The Indian Express

"The World Market Force: U.S. Demand Exceeds Total World Production."

Open Newspaper

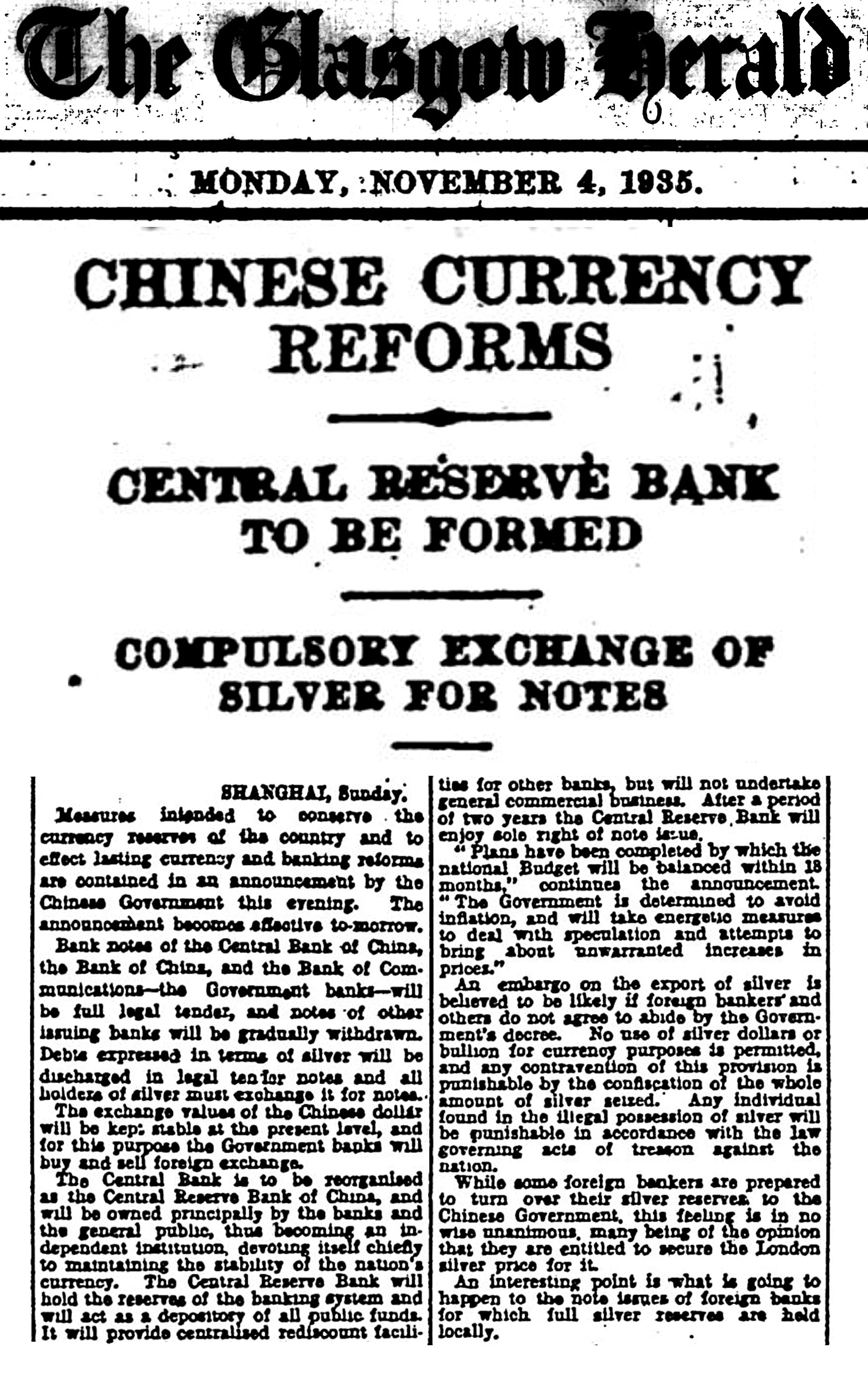

The Glasgow Herald

"Compulsory Exchange: Holding Physical Silver Declared Treason Against the Nation."

Open Newspaper

The Gazette (Montreal)

"Mass Exchange: China Swaps Physical Silver for Gold Held in U.S. Vaults."

Open Newspaper

The Southeast Missourian

"Funding Resistance: China Liquidates $430M in Silver to Finance War."

Open Newspaper

The Bend Bulletin

"High U.S. Price: The Artificial Magnet Draining China's Physical Wealth."

Open Newspaper

The Malakoff News

"The Inflationary End-Game: Predictions of a Hollowed-Out Economy."

Open Newspaper

Warsaw Daily Union

"The Final Cleanup: U.S. Seizes Remaining Hoards of Gold and Silver in Tokyo."

Open NewspaperDisclaimer: For Informational and Educational Purposes Only

The information presented on this site is for informational and educational purposes only and does not constitute financial, investment, or legal advice. The data is sourced from publicly available information and archives believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. The 'Adjusted' price values are theoretical calculations based on a conceptual model and do not represent actual market prices or a recommendation to buy or sell any security. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial professional before making any investment decisions. All data is sourced from third parties and is not guaranteed. Use at your own risk.